While opening a credit card can seem fun and give you a sense of financial freedom, it’s important to know a few things before you decide to go on a shopping spree. Here are some tips you’ll want to keep in mind before opening a credit card and even after you get one.

1. Understand how credit cards work

Before getting a credit card, it’s important to understand how they work. Credit cards allow you to borrow money that you have to pay back with interest. Some will waive interest for a certain amount of time, but you still have to make a monthly payment which is a percentage of your current balance. If you don’t pay back what you borrowed in time, you can damage your credit score.

2. Understand your credit score

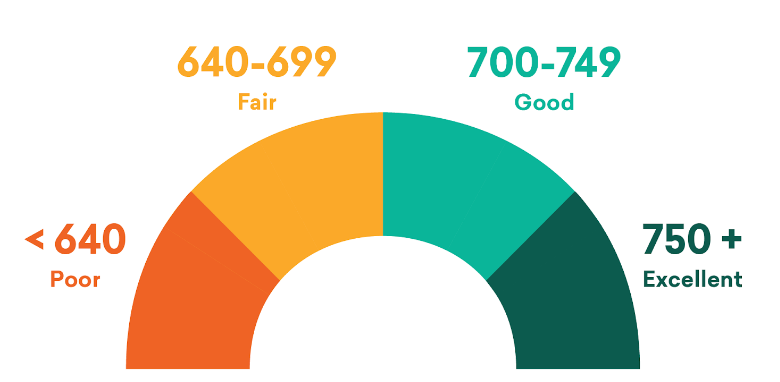

A credit score is basically a scorecard of how good you are at making payments, paying on time, how much debt you have, and other similar factors. It’s basically a report card for your finances. It usually ranges from 300-850. The higher your credit score, the more likely you are to get approved for other cards, loans, and mortgages.

3. Choose a credit card wisely

When selecting one, look for one with a low-interest rate and no annual fees. Some cards offer cash back on certain things such as gas or food, other cards offer miles for flying. It’s important to pick a card with perks that best benefit you. Also, make sure to read the fine print to understand the terms and conditions of the card.

4. Consider a secured credit card

If you don’t qualify for a traditional credit card, or you want to start with something more manageable, consider a secured one. Like a regular credit card, your credit limit is based on your security deposit. Basically, if you put $500 into your account, $500 is your credit limit. This can be a good way to build credit and learn responsible credit habits.

- Create a budget

It’s important to have a budget in place before using a credit card. Make a plan for how much you can spend each month and stick to it. It can be very tempting to finally buy that tv or pair of sneakers you’ve always wanted, but just remember you’ll end up paying it eventually. Not the best at budgeting? Read this article from NerdWallet on 8 different budgeting apps that’ll save you time and money.

- Make your payments on time

Late payments can damage your credit score and result in accruing fees. To avoid this, you can set up automatic payments or reminders to make sure you pay on time, but make sure you have enough money in the back for your payment – or else you’ll get what’s called an “insufficient funds fee”.

- Monitor your spending

Keep track of your credit card spending and check your statements regularly to ensure you’re not overspending or being charged for unauthorized transactions.

- Don’t max out your limit

It’s best to keep your credit utilization ratio (the amount you owe compared to your credit limit) below 30% to avoid damaging your credit score. For example, if your credit limit is $500, you’ll want to limit your spending to $150 (30% of 500) or less. This credit utilization calculator from BankRate is a great tool to use if you’re not sure what your utilization is.

- Monitor your account regularly

A good habit to form is to keep an eye on your account to make sure there are no unauthorized charges, and to track your spending. This will help you stay on top of your finances and avoid surprises at the end of the month.

Remember, your credit score can fluctuate because of many different factors, some out of your control. Low age of accounts, closing a credit, new credit, these are all things that can affect your credit score that shouldn’t discourage you. However, be sure to take care of things such as payments and fees so it doesn’t drop down too low.

Building credit isn’t a hard thing to do, but it requires discipline. Always keep in mind that one should be mainly used for needs, not wants. You don’t have to restrict yourself from things you really want, but make sure you have the funds to pay it off.