So, you want to be financially responsible? Congrats, welcome to adulthood! You’ll be doing this for the rest of your life. Navigating finances can be scary, but starting early can save you a lot of stress in the long run. Here, I’ll teach you the basics of saving, making smart financial decisions, and other tips and tricks.

Budgeting Basics

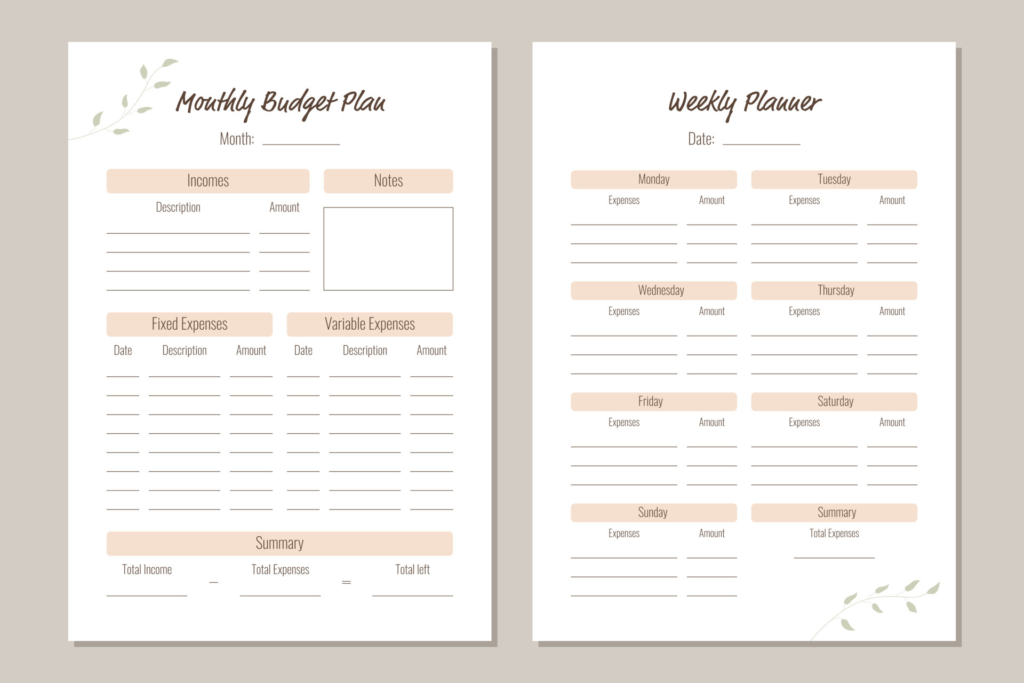

The foundation of financial responsibility is creating and sticking to a budget. Start by listing your sources of income, such as allowances, part-time jobs, or gifts. Next, outline your monthly expenses, including essentials like school supplies or transportation, and personal spending on things like outings, subscriptions, and any other things you like to spend money on. Allocate a portion of your income to savings and emergency funds. By tracking your spending and adjusting your budget as needed, you can start to see just how much money you’re spending, where you can cut down, and how you can save more money. You can write this down in a notebook, or buy a budget planner.

Saving Money Early and Often

One of the most powerful financial habits you can develop as a teenager is saving money. Whether it’s 1% or 50% of your income, saving money is a great habit to build young. You can set aside a small amount of your income for short-term goals, like buying new clothes, and for long-term goals, such as education or travel. Consider opening a savings account to earn interest on your funds.

Learn About Investing

Saving is essential, but investing can take you to the next level financially. Research and understand the basics of investing, such as stocks, bonds, and mutual funds. Consider investing in low-risk options initially, and as you gain confidence, you can explore more diverse investment opportunities. Keep in mind that investing is a long-term commitment, and the earlier you start, the more you can benefit from it.

Build Your Credit

As a teenager, you may think it’s too early to build your credit, but it’s something that’ll make your adult life much easier. A good credit history is essential for taking out loans, renting an apartment, and even getting a job in some cases. Start by understanding the basics of credit, such as credit scores and how they are calculated. Once you’ve read up on the basics, you can open up a credit card and check out my other article on credit card tips.

Set Financial Goals

Just like when you’re trying to accomplish anything else, setting a clear financial goal provides direction and motivation. Whether it’s saving for a dream vacation, funding your education, or building an emergency fund, having a specific goal will help you stay focused. If you have any larger goals, break them down into smaller, achievable steps, making it easier to track your progress and celebrate your financial victories.

All in all, while adulting may seem scary, starting early and getting the hang of things can save you a lot of time in the future. Stay educated and good things will come!